We recently hosted a live discussion between Geni Whitehouse, Erik McLaughlin, and Ashley Leonard. These seasoned winery finance experts chatted about the financial challenges wineries face and shared best practices essential for wineries to follow in 2024.

Check out the highlights below, including clips from the event, or you can watch the entire recording on demand here.

State of the Wine Industry

The hard truth is that, similar to every other industry, the wine industry is being negatively impacted by current events. With the decline of wine consumption, changing economic climate, increasing costs, and ever-evolving market demands, wineries are navigating a complex landscape.

But, mastering winery finances, while a major point of frustration for many in the industry, is not a new challenge. And it’s a popular topic, evidenced by the number of folks that reached out to join the discussion. CEOs, GMs, winemakers, CFOs, controllers, accounting and CPA firms, bankers, and more!

So, why is it so challenging to master winery finances? Ashley shares that there are several reasons, too many to write out in this blog post. The main takeaway? The wine industry needs more informed and experienced support.

Have a listen:

Biggest Financial Mistakes Wineries Make

According to our panelists, wineries make four key mistakes in managing their finances:

- Poor cash management

- Inaccurately tracking and reporting on COGS

- Ineffective coordination across departments

- Unsuccessfully collaborating with finance partners

Let’s dive into how to tackle these issues with takeaways from our experts.

Mistake #1: Poor Cash Management

Breaking Free from the Cash Chase Cycle

Erik McLaughlin, CEO at Metis, stresses the importance of an accurate picture of your cash health. A common misconception is that if sales are growing, the winery is healthy. The problem with this is that it only recognizes half of the equation. Disregarding costs can sink a winery’s cash on hand. Erik’s advice? Stop thinking of wineries as week-to-week cash flow businesses and begin forecasting revenue and expenses three years out. This shift lets you make smarter decisions, rather than just scrambling to cover the next bill with quick sales and discounts.

Check out what Erik has to say about the cash chase cycle:

Setting Clear Financial Benchmarks

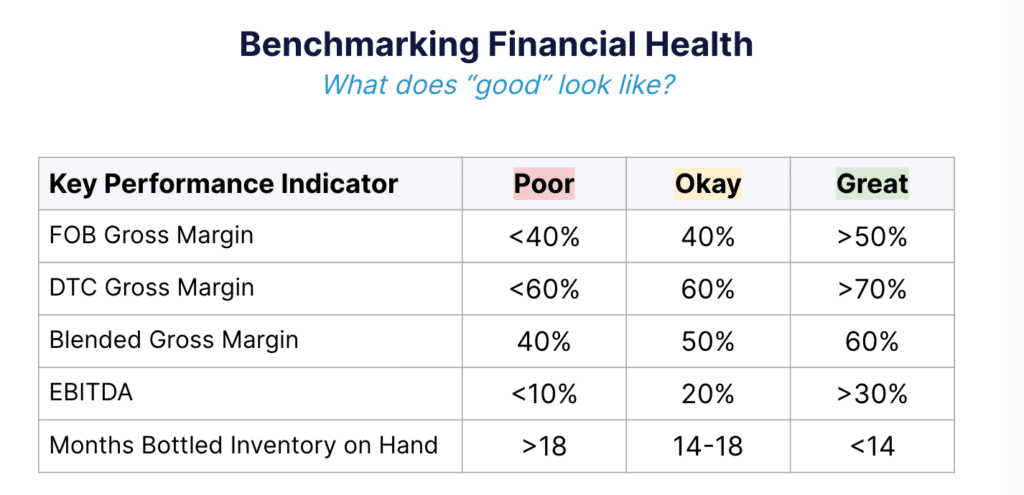

Start setting clear financial benchmarks, particularly in gross margins and EBITDA. Erik suggests aiming for a minimum of 40% gross margin as a baseline for financial viability. Aim higher, like 50% or 60%, and you’re golden. But dip below 40%, and you’re in choppy waters.

Another critical measure of your winery’s health is EBITDA (earnings before interest, taxes, depreciation, and amortization). Erik’s take? If you’re below 10% EBITDA, you’re just treading water. But hit that sweet spot between 20% and 30%, and you’ve got a winery that’s not just surviving, but thriving.

Here’s Erik on why financial benchmarks matter:

Looking for a cheat sheet? Check this out:

Mistake #2: Inaccurately Tracking and Reporting on COGS

Capturing Detailed Cost Data

Tracking true costs starts with making a conscious decision to do so and then recording detailed transactional data. This means not just logging an invoice but allocating it accordingly: Was this cost for my reds only, or all my inventory? In the below clip, Geni shares that wineries often miss capturing the finer details in their transactions, inaccurately depicting their true costs.

Geni dives into the nitty-gritty of COGS tracking:

Leveraging Technology for Cost Allocation

Start tackling cost allocations on a monthly basis so that by the time year-end rolls around, you’re not left with a pile of unsorted financial puzzles. Here’s where software tools like InnoVint shine. They provide a clear, ongoing snapshot of your finances, allowing for timely adjustments and a smoother end-of-year process.

Geni explains how InnoVint revolutionizes cost management:

Mistake #3: Ineffective Coordination Across Winery Departments

Winery departments are notoriously poor at working effectively together. Everyone’s working in their own world – winemakers in one corner, accountants in another, and sales teams in yet another. The result? A bunch of disconnected data islands with no one having the complete picture.

Education and Collaboration

Even if your team has the right tools, do they know how to use them effectively? Your accountants might be in the dark about accessing a software costing tool, simply because they never thought to ask the winemakers. Geni shares that the fix is to foster a culture of education and collaboration. When teams start communicating and sharing knowledge, those disconnected islands start to connect, forming an accurate picture of the winery’s operations and finances.

Mistake #4: Unsuccessfully Collaborating With Finance Partners

Get curious about your financials. As a winery owner, you should be challenging assumptions and asking your accountant how they handle certain practices, from inventory cost accounting to sales forecasting. It’s these details that can make or break your understanding of the winery’s financial health.

Don’t just nod along to the financial reports; dive in! Understand the why and how to get that crystal-clear picture of where your money’s going to make sure it’s all adding up just right.

Here’s what Geni has to say:

Your Next Steps in Winery Financial Mastery

To stay ahead in the ever-changing wine industry, it’s crucial to avoid these common financial mistakes. These steps are key to maintaining a healthy bottom line, from enhancing cash management to fostering effective communication. Look at your current practices and explore how winery software tools like InnoVint can help you streamline your operations.

Watch the full webinar for detailed advice and insights. Stay informed, stay ahead, and make your winery’s financial health a top priority this year!